Instructions for completing the Property Information checklist:

General Headings

This Property Information checklist helps you list all the property you own and what it is worth. If you do not own property under a particular heading, just leave that section blank. Under certain headings, you may own more property than can be listed on this checklist.

Type

Immediately after the heading for each kind of property is a brief explanation of what property you should list under that heading.

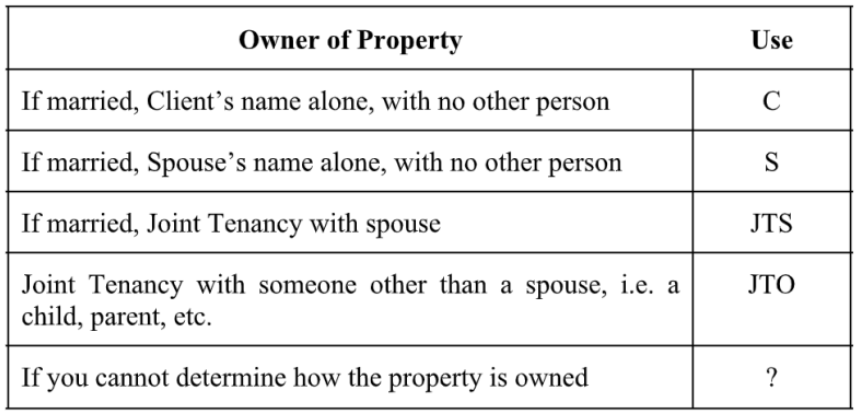

"Owner" of Property

How you own your property is extremely important for purposes of properly designing and implementing your estate plan. For each property, please indicate how the property is titled. When doing so, please use the following abbreviations:

Real Property

Real Property: Any interest in real estate including your family residence, vacation home, timeshare, vacant land, etc.

Furniture and Personal Effects

List separately only major personal effects such as jewelry, collections, antiques, furs, and all other valuable non-business personal property (indicate type below and give a lump sum value for miscellaneous, less valuable items).

Automobiles, Boats, and RVs

For each motor vehicle, boat, RV, etc. please list the following: description, how titled, market value, and encumbrance.

Bank Accounts

Checking Account "CA", Savings Account "SA", Certificates of Deposit "CD", Money Market "MM" (indicate type below).

Do not include IRAs or 401(k)s here.

Note: If Account is in your name (or your spouse's name) for the benefit of a minor, please specify and give minor's name.

Stocks and Bonds

List any and all stocks and bonds you own. If held in a brokerage account, lump them together under each account (indicate type below).

Life Insurance Policies and Annuities

Term, whole life, split dollar, group life, annuity. ADDITIONAL INFORMATION: Insurance company, type, face amount (death benefit), whose life is insured, who owns the policy, the current beneficiaries, who pays the premium, and who is the life insurance agent.

Retirement Plans

Pension (P), Profit Sharing (PS), H.R. 10, IRA, SEP, 401(K). ADDITIONAL INFORMATION: Describe the type of plan, the plan name, the current value of the plan, and any other pertinent information.

Business Interests

General and Limited Partnerships, Sole Proprietorships, privately-owned corporations, professional corporations, oil interests, farm, and ranch interests. ADDITIONAL INFORMATION: Give a description of the interests, who has the interest, your ownership in the interests, and the estimated value of the interests.

Money Owed To You

Mortgages or promissory notes payable to you, or other moneys owed to you.

Anticipated Inheritance, Gift, or Lawsuit Judgment

Gifts or inheritances that you expect to receive at some time in the future; or moneys that you anticipate receiving through a judgment in a lawsuit. Describe in appropriate detail.

Anticipated Inheritance, Gift, or Lawsuit Judgment

Other Assets

Other property is any property that you have that does not fit into any listed category.

Summary of Values

Joint Property values enter 1/2 in client's column and 1/2 in spouse's column.

PERSONS TO ACT FOR YOU

GUARDIAN FOR MINOR CHILDREN

If you have any children under the age of 18, list in order of preference who you wish to be guardian.

INITIAL TRUSTEE(S)

Usually the Maker will be the Trustee of his or her own trust. Often, both spouses, jointly. Allows you to continue to jointly control your assets as before.

DISABILITY TRUSTEE

If you were unable to make decisions for yourself, who would you want to make decisions for you with regard to your property and assets?

CLIENT - Disability Trustee

SPOUSE - Disability Trustee

DEATH TRUSTEE

After your death, who do you want carrying out your instructions, for distribution to and, if desired, management of property for your beneficiaries?

CLIENT - Death Trustee

SPOUSE - Death Trustee

POWER OF ATTORNEY

If you were unable to make financial decisions for yourself, who would you want to make those decisions for you?

CLIENT - Power of Attorney

Spouse - Power of Attorney

LIVING WILL

Client - Health Care Power of Attorney

Spouse - Health Care Power of Attorney

SPECIFIC GIFTS

List any specific gifts you wish to make to either individuals or charities. Indicate whether these gifts are to be made even if the other spouse is alive. We strongly recommend the use of specific gifts. Common items included in this section are highly valuable items, items with significant sentimental value, jewelry, art, firearms, etc.

Client - Specific Gifts

Spouse - Specific Gifts